A False Positive: USDA’s Farm Income Projection

Key Takeaways

- Due to increases in projected farm profitability for the dairy, livestock, and poultry sectors, USDA’s most recent farm income forecast made historically large upward revisions in their outlook for U.S. farm profitability. This forecast, however, works to conceal the real economic challenges facing America’s farm and ranch families.

- The farm-level profitability projections for corn, soybeans, hogs, wheat, cotton, and other crops are the worst (or among the worst) in the last 15 years when adjusted for inflation. Implications that the farm economy is closing out a four-year streak of net farm income above the 20-year average fail to adequately put into perspective the dire economic hardships now faced by large segments of the agricultural economy.

- In response to this challenging landscape, the Senate Republican-drafted farm bill framework steps in by making historic investments in the farm safety net. These investments, including Title I programs and crop insurance, aim to support farmers through the expected prolonged downturn in the farm economy.

U.S. net farm income and U.S. net cash farm income have long been the flagship measures of the overall health of the U.S. farm economy and overall farm profitability.* However, the challenge with utilizing a broad economic indicator such as net farm income is that it can mask underlying – potentially severe -- financial challenges. This is the case with USDA’s most recent 2024 Farm Sector Income Forecast.

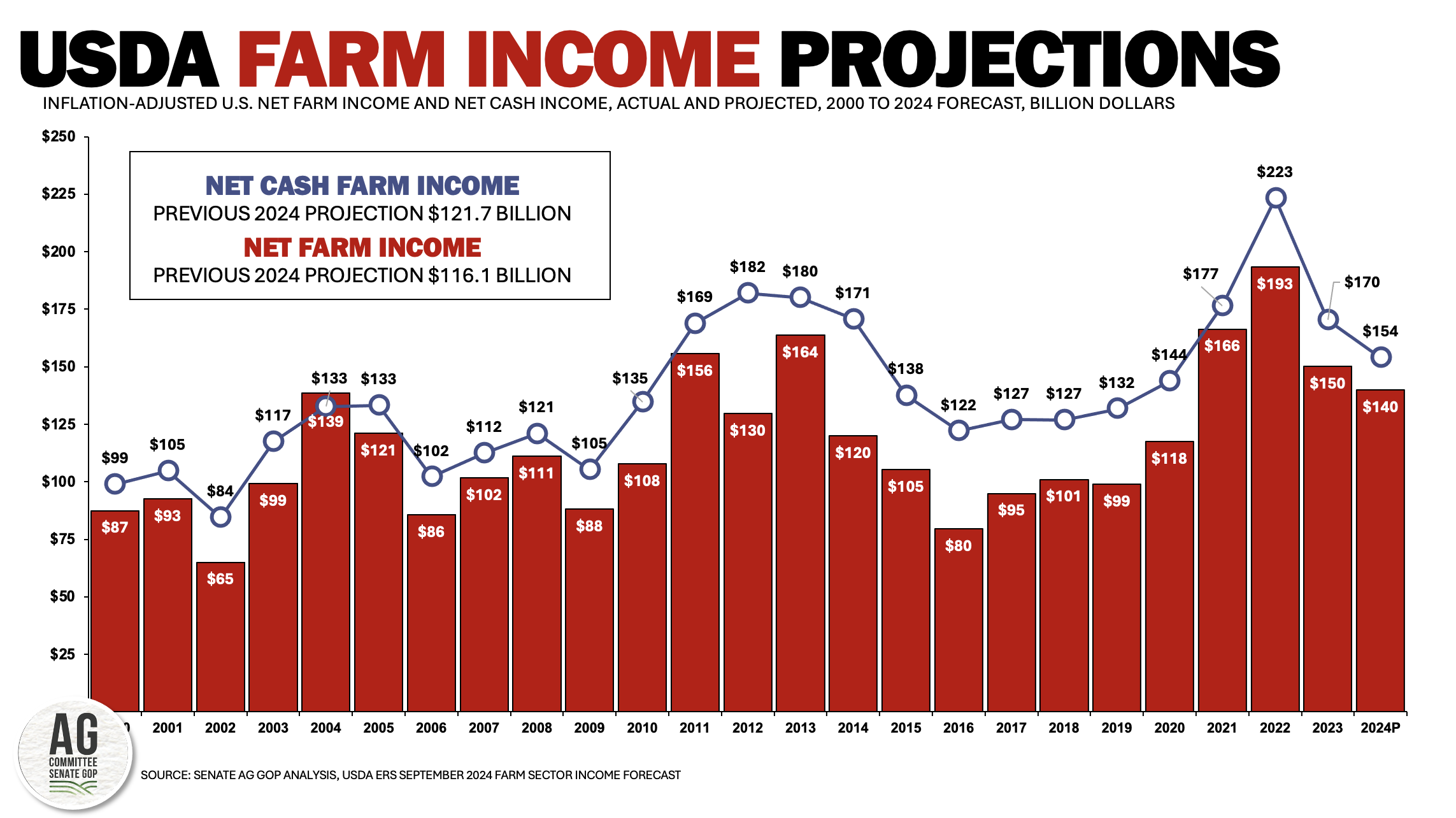

While many agricultural economists anticipated USDA would further lower its farm income forecast, USDA’s recent update to the farm income forecast made the second-largest upward revision to farm income over the last decade, increasing the projection for 2024 net farm income by nearly $24 billion to $140 billion. If realized, this new net farm income projection would be down 4 percent, or $6.5 billion from 2023. While USDA made the upward revision to U.S. net farm income, relative to the highs of 2022 U.S. net farm income remains off by 23 percent, and, when adjusted for inflation, is still experiencing the third-largest two-year decline in history.

U.S. net cash farm income, which reflects the year in which the crop or livestock products were sold, was revised upward by $32 billion and is now projected to fall to $154 billion in 2024, down 7 percent from 2023, and down 27 percent, or $56 billion, from the highs reached in 2022. When adjusted for inflation, the two-year decline in U.S. net cash farm income continues to represent the steepest drop in U.S. net cash farm income of all time.

The Farm Economy Remains Under Significant Pressure

Due to improved farm profitability forecast for the dairy, livestock, and poultry sectors, USDA’s most recent farm income forecast conceals the significant economic downturn being experienced by America’s corn, soybean, hog, wheat, cotton, rice, peanut, and other row and specialty crop farm families. Importantly, implications that the farm economy is closing out a 4 year four-year streak of net farm income above the 20-year average fail to adequately put into perspective the dire economic hardships now faced by large segments of the agricultural economy.

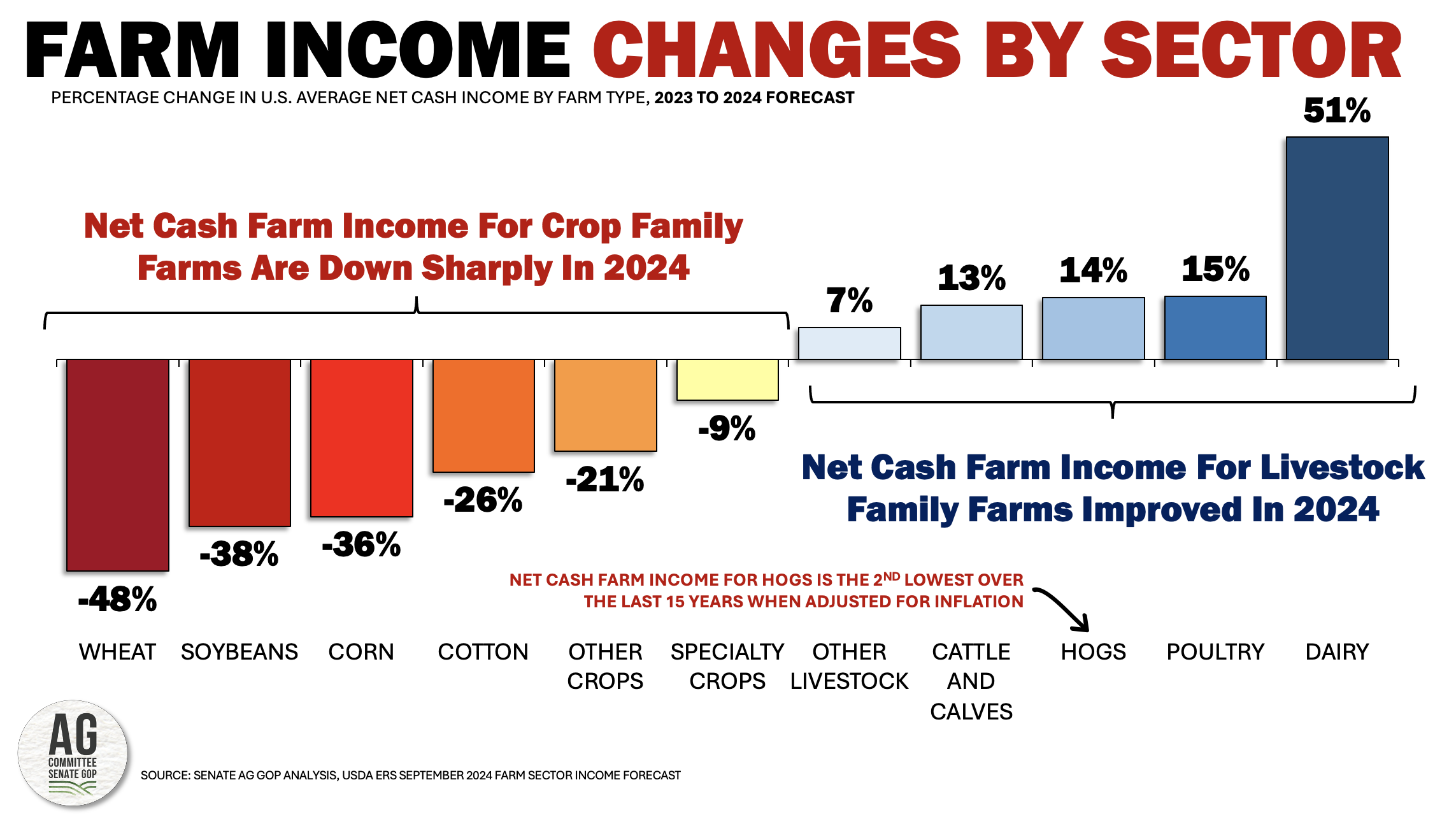

Driven by rapidly declining commodity prices, and elevated input costs such as interest, taxes, machinery and repair, seed costs, chemicals, and storage, 2024 average net cash farm income for wheat family farms is projected to decline by 48 percent, soybean farms are in line for a 38 percent decline in income, corn net farm income is projected to decline by 36 percent, and cotton net farm income is projected to decline by 26 percent. When adjusted for inflation, the net cash farm income projections for corn, soybeans, wheat, and other crops are the worst in the last 15 years (since the data was first recorded).

While row crop family farmers are experiencing a significant financial downturn, USDA is projecting improvements in the net cash farm income for livestock and poultry farmers. Dairy farm net cash farm income is projected to increase by 51 percent year-over-year, poultry farmers (led by eggs) are projected to experience a 15 percent increase in net cash farm income, net cash farm income for hog producers is projected to increase by 14 percent, and for cattle families, net cash farm income is projected to increase by 13 percent compared to 2023.

While livestock and poultry profitability are projected to improve, it’s also important to put these projections into perspective. For example, while the outlook for hog farm profitability is improved, it’s an increase from historically low net cash farm income and the second lowest after adjusting for inflation. While average poultry and dairy farm incomes are at or near historic highs, many dairy and poultry farm families have been devastated by the catastrophic and multi-year outbreak of highly pathogenic avian influenza. Cattle producers are experiencing an improved economic outlook, but replacement costs to build the herd and financing costs remain elevated – limiting the ability for these farm families to benefit from the improved economic outlook.

Elevated Concerns Going Into 2025

The significant economic headwinds facing crop and livestock families is easily overlooked if viewed through the lens of U.S. aggregate net farm income or solvency measures such as the debt-to-asset ratio or the current ratio. Outside of improved crop and livestock prices, the hope in farm country is that there will be some relief in farm production expenses alongside the enactment of a new five-year farm bill that improves the economic sustainability of farming and life in rural America. The latter point is why there is a continued chorus calling for “more farm in the farm bill."

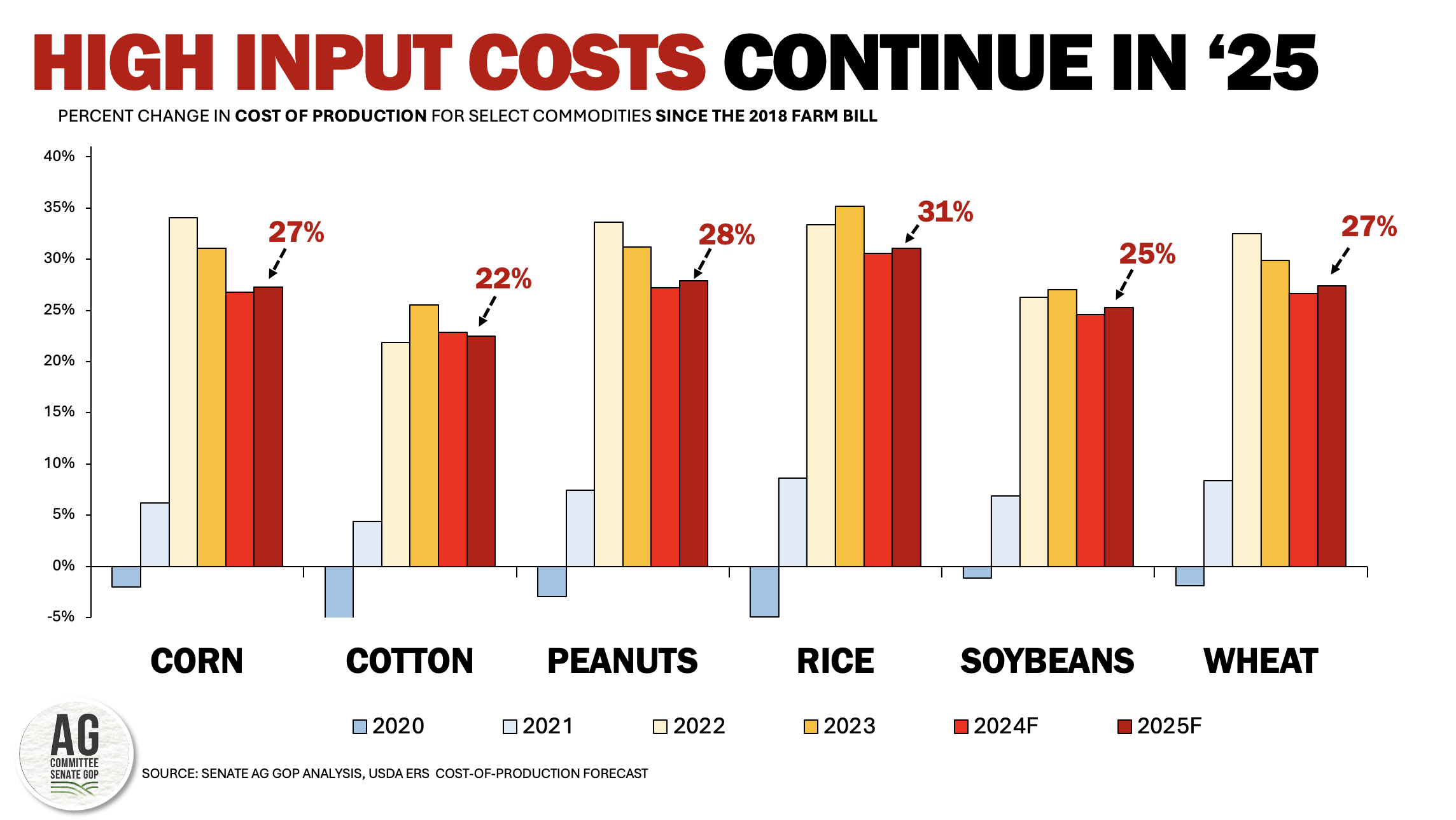

Unfortunately, relative to input costs USDA’s first cost-of-production forecast for major U.S. field crops for 2025 reveals higher production expenses for barley, corn, oats, peanuts, rice, sorghum, soybeans, and wheat next year. For these major crops, the cost-of-production remains 22 percent to 31 percent above the cost-of-production upon enactment of the 2018 farm bill. For livestock operations the costs of labor, replacement livestock, interest, taxes, and repair are expected to remain stubbornly high.

The onus for relief then is on Congress. The Senate Republican-drafted farm bill framework modernizes the farm safety net, facilitates the expansion of access to overseas markets, fosters breakthroughs in agricultural research, and grows the rural communities our farmers, ranchers, and foresters call home – all while making a historic investment in conservation and protecting nutrition programs that help Americans in need.

Now is the time to advance a bill that meets this pivotal and economically challenging moment in farm country and across rural America.**

*Net cash income is based on the year in which farm sales of crop or livestock products occur and net farm income is based on the year the production occurred.

** USDA’s next projection for 2024 farm income and wealth will be released December 3, 2024, and the first projection for 2025 farm income and wealth statistics will be revealed in early 2025.