Revisiting Farm Production Expenses

Key Takeaways

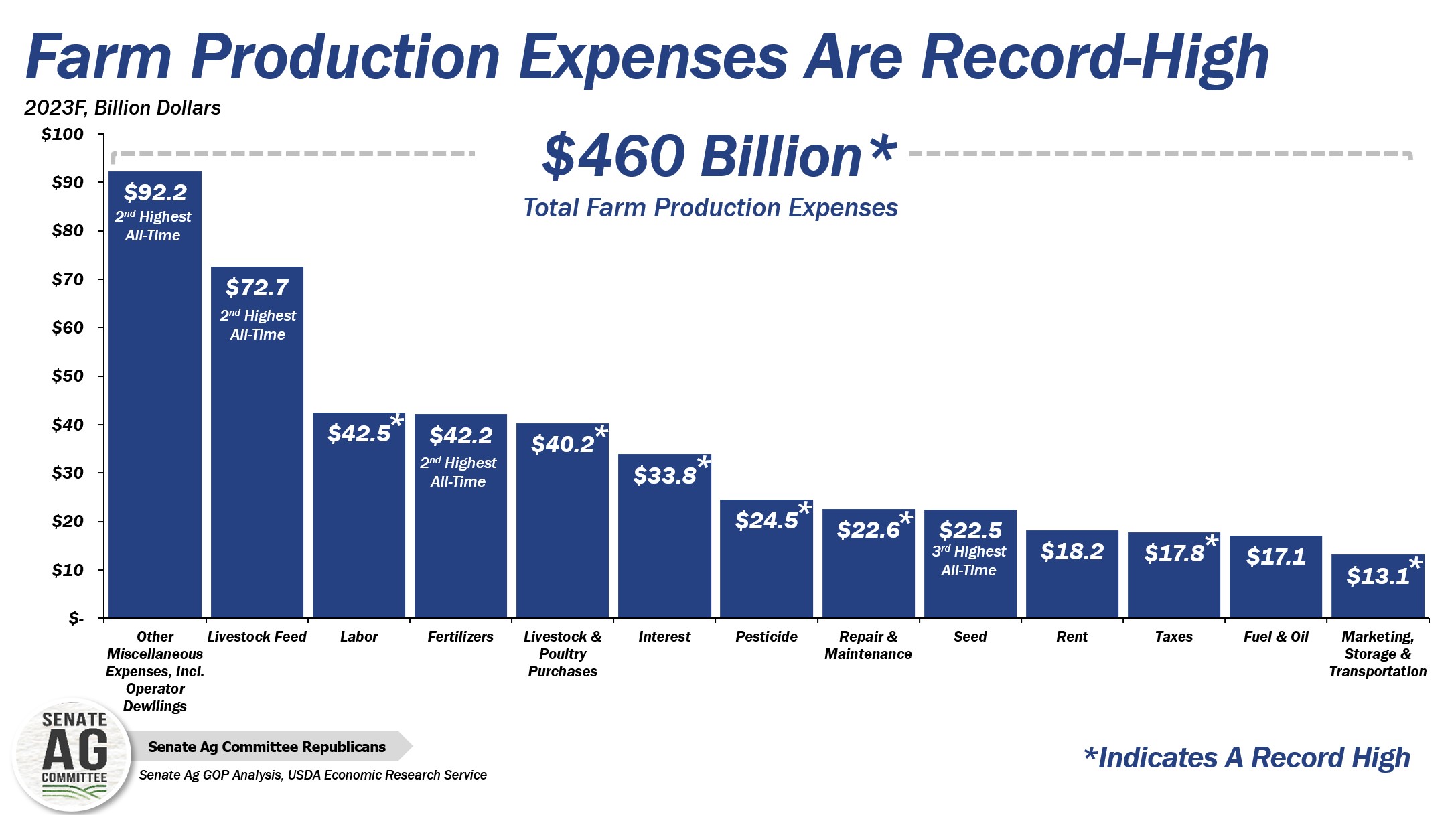

- Farm production expenses were projected to be record-high in 2023 at nearly $500 billion, up 28% or $87 billion under this administration.

- While diesel fuel and fertilizer prices have fallen slightly from their record highs one year ago, the prices for fuel and fertilizers remain 60% to 130% higher than their January 2021 levels.

- Other farm expenses such as land, cash rents, labor, farm equipment, and interest expenses continue to increase or are holding near record highs – indicating that inflationary pressure on agricultural input costs continues to be acutely felt by farmers.

Alongside historic inflation across the broader U.S. economy, the highest in over 40 years, farmers and ranchers across the country experienced their own version of inflation: soaring land values, cash rents, fertilizer, fuel, chemical, animal feed, machinery, and interest expenses, among many others. USDA’s February 2023 Farm Sector Income forecast projected total farm production expenses in 2023 at nearly $500 billion, up 4% from the prior year, but up $87 billion or more than 28% from two years prior. In fact, the increase in farm production expenses from 2020 to 2023 represented the sharpest two-year increase in farm input costs of all time.

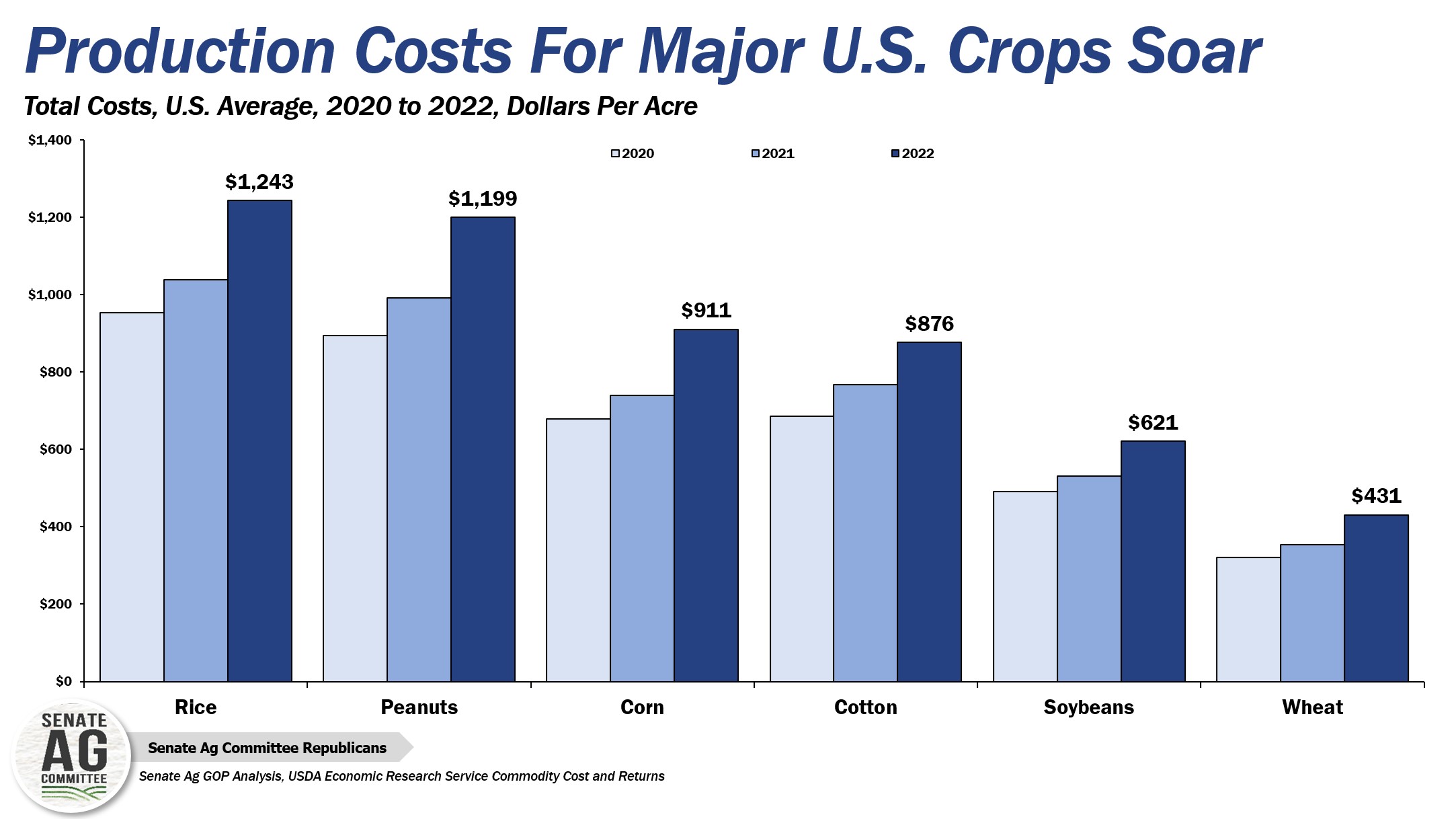

In May, USDA’s Commodity Costs and Returns re-confirmed that input costs for all major crops were indeed at a record in 2022, ranging from $431 per acre for wheat, $621 per acre for soybeans, $876 per acre for cotton, $911 per acre for corn, and at or above $1,200 per acre for both rice and peanuts. Livestock producers also experienced record- or near-record-high costs of production with cow-calf costs at nearly $1,700 per head, hogs at $106 per head, and milk at $28 per hundredweight. In June, USDA will update its 2023 cost-of-production forecast for these major crops.

To provide some perspective on the inflationary pressure farmers continue to face, this analysis will review recent developments in farm input costs since USDA first released its estimate of 2023 farm production expenses in February 2023.

Starting with fertilizers and diesel fuel, USDA’s Illinois Production Cost Report reveals that the cost of urea, potash, along with nitrogen- and phosphate-based fertilizers reached an all-time high in May or June of 2022 -- approximately one year ago. The price for farm diesel reached an all-time high in late June 2022 at $5.30 per gallon. Compared to their all-time high, it is true that the cost of fertilizers and fuel are approximately 15% to 30% lower than year-ago levels.

But…it’s also true that under this administration the cost of fertilizers and fuel remain well above their historical averages. Compared to mid-January 2021, the cost of anhydrous ammonia is up nearly 130%, the cost of phosphate-based fertilizers is up approximately 60%, and potash prices are up nearly 70%. Similarly, diesel fuel prices remain 63% higher than their January 2021 levels.

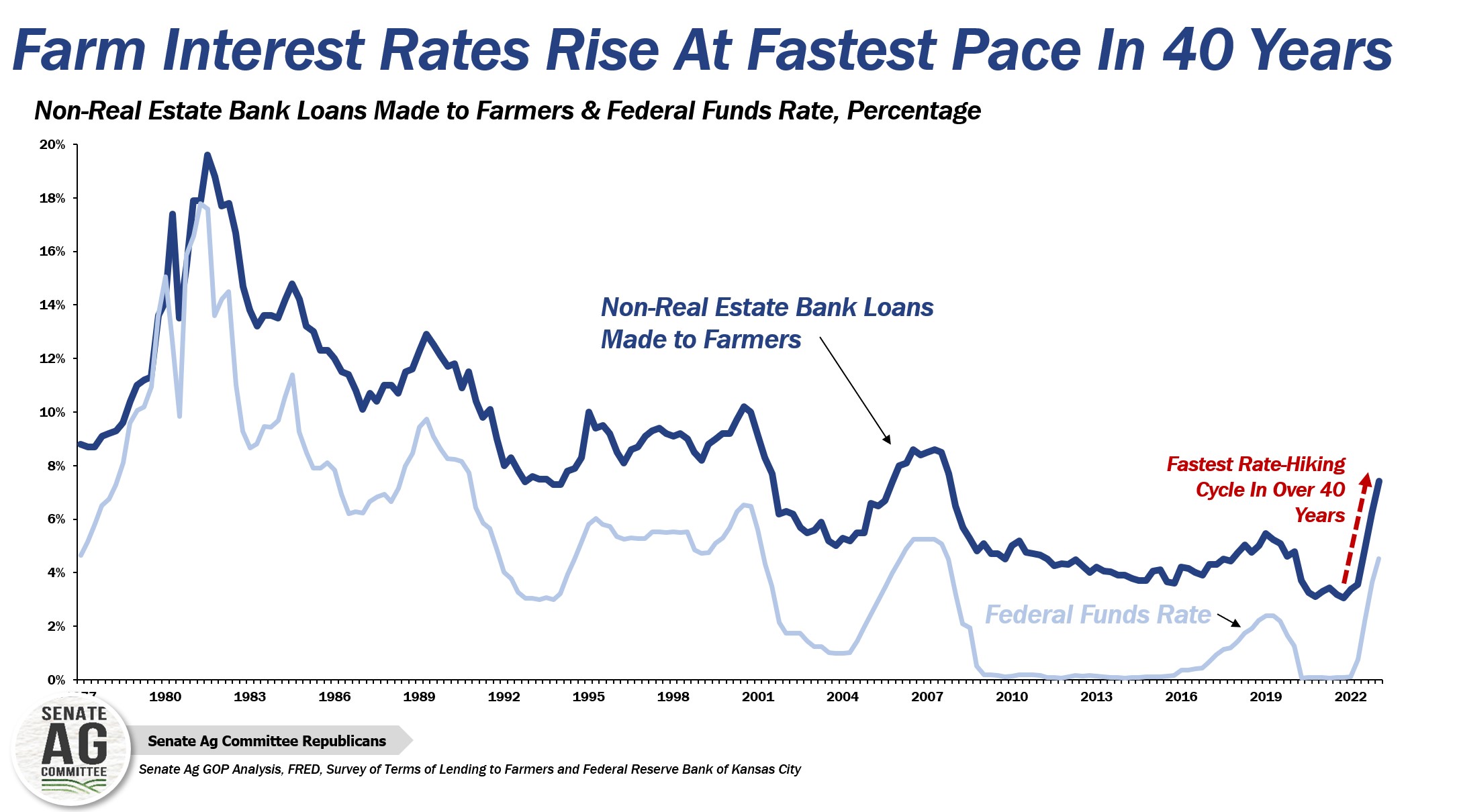

Higher input costs also increase the borrowing needs of farmers. To combat inflation, however, the U.S. Federal Reserve began the most aggressive rate-hiking cycle in modern history, raising rates from near zero in March 2022 to a 16-year high. As a direct result average farm interest rates have increased from a low of nearly 3% in late 2021 to an average of 7.4% in the first quarter of 2023, an increase of 143% in just over a year’s time. Using the average-sized USDA guaranteed operating loan of nearly $330,000 as an example, the rise in interest rates would result in interest expenses increasing from $9,900 in 2021 to more than $24,000 on the same-sized operating loan today (based on yearly amortization and excluding patronage).

Continued strains in the banking sector will tighten access to credit. With the Federal Reserve again announcing a 25-basis point increase in the federal funds rate, the tenth increase since March 2022, for farmers seeking access to credit the only direction for farm interest expenses to go is up. More concerning given the pace of rate hikes is that nearly 80% of non-real estate farm loans originating in the second half of 2022 or later have a floating (variable) interest rate.

The story is the same across agriculture. While higher interest rates may slow the rate of growth in asset values, the increases in farmland prices or cash rents for cropland and pasture are well documented. Livestock feed prices remain elevated, and only one other time in the cattle cycle history have feeder cattle gone for more than $200 a hundredweight. Machinery Pete forecasts used tractor and combine values will remain at record highs in 2023.

For more than 20 consecutive months the year-over-year growth rate in U.S. average hourly earnings has paced at an average increase of 5.1%. Similar (or higher) growth has been experienced in wages reported in both the Occupational Employment Survey and the H-2A program’s adverse effect wage rates. With close to 10 million open jobs across the economy, equivalent to 1.6 jobs per unemployed worker, labor expenses will continue to weigh heavy on a farmer’s general ledger.

The challenge with rising farm input prices is price stickiness – meaning farm input costs are not likely to decline sharply and may in fact have reached a new normal. As evidence consider that USDA’s prices paid index for commodities, services, interest, taxes, and farm wages has experienced a year-over-decline fewer than 14% of the time across a time period spanning more than 2 decades. Sure, some prices may come down, but agricultural production costs are unlikely to retreat significantly anytime soon, and 2021 and 2022 are more than likely to be closer to the new normal than outliers to the U.S. farm economy.